Goods and Services Tax (GST) became the pillar of the indirect tax system in India and provided uniformity as well as transparency among the large and small businesses. Nevertheless, GST compliance isn’t always easy to manage, particularly in the case of small and medium enterprises that are too busy with various tasks. Whether it is the creation of GST-compliant invoices or precise returns and reconciliation of mixed-up content, there is a lot that needs to be accurate to save a business the costly penalties and allow it to run smoothly. It is here that GST software is important.

The current software in the GST streamlines the process by automating various tasks, including billing, calculation of sales tax, input tax credit (ITC) reconciliation, and filing of returns. They are structured to reduce computer and human errors, conserve time, and comply with current GST rules. An efficient GST billing software can help organisations save time when it comes to accounting and tax-related activities, whether you are a startup, an expanding SME, or a well-established enterprise, and focus more on growth.

These feature-rich GST software tools are also available in the market in India, where each tool works differently to suit the various businesses. Others specialize in simple invoicing, and others specialize in advanced reconciliation or multi-branch management. This blog presents the top GST software in India to file returns, bills, and reconcile GST, and assists you in selecting the one best suited to your needs.

Understanding the Best GST Software for Return Filing, Billing & Reconciliation

By the term Best GST Software in India to File Returns, Bill and Reconciliation we mean the specialized accounting and tax management software that can support three main GST-related business activities:

Return Filing: A GST filing (such as GSTR-1, GSTR-3B, etc.) has to be done on a monthly/quarterly basis. It is cumbersome to manually create them, and could result in making errors. The GST platforms do the input automatically, auto-fills, and files returns directly on the web and saving time and errors.

Billing: Businesses will be expected to issue GST-compliant invoices that contain HSN/SAC codes, GSTIN, tax breakups, and digital signatures. GST billing software will make sure that all invoices are supported according to government regulations, and they can be issued within a short period of sale, purchase, or e-invoicing.

Reconciliation: GST is one of the most challenging tasks in matching purchase invoices (GSTR-2A/2B) with the sales invoices uploaded by suppliers. When there are mismatches, there is a loss of Input Tax Credit (ITC). GST software can automatically reconcile mismatched invoices and highlight discrepancies, and ensure maximum ITC claim.

List of Top GST Software in India

1. Indian Govt. GST offline Utility

The Indian Government GST Offline Utility was generated and granted by the GST Network (GSTN) in order to assist and offer a free compliance tool to the Indian Government. It has been exclusively developed to benefit the taxpayers who would like to prepare GST returns without any internet connection assistance during the process. Users will be able to download the offline tool, enter invoice details, create bug-free JSON files, and subsequently upload them to the GST portal. This renders it a very effective tool for companies operating in locations with low levels of internet connection.

We have checked important GST forms like GSTR-1, GSTR-3B, GSTR-9, and GSTR-9C, and regular monthly returns and annual reporting forms are supported in the tool. Because it is an official government tool, correctness, safety, and links with the latest GST norms cannot be in question. It is ideally suited to small businesses and individual taxpayers, and accountants that require a cost-effective solution with a failsafe to manage their GST requirements. The offline utility also lowers the dependency on third-party software and provides direct government regulations compliance at zero cost.

Key Features:

- Free government-sponsored tool

- Works without an internet connection; only the internet is needed to send information

- Supports the various forms of GST (GSTR-1, 3B, 9, 9C)

- Pre-filing erroneous identification and validation

- Auto JSON file creation and upload

- Safe and directly connected with the GST portal

Pricing: Free

Product Page: https://gst.gov.in

Support: 1800-103-4786

2. Gen GST Online Software (SAG Infotech)

GST by SAG Infotech is a comprehensive GST return filing and billing software designed with professionals, accountants, and enterprises. It has both a desktop and a cloud solution, and it is also applicable to tax consultants and CA firms because it enables users to handle unlimited clients and file unlimited returns. The software streamlines the GST returns filing processes by automating GSTR-1, GSTR-3B, and GSTR-9 processes, as well as reconciliation of mismatched invoices, and thus reduces time.

It also allows GST-compliant invoicing, e-way bill creation, and input tax credit (ITC) monitoring, which makes it convenient to comply with GST to businesses of any size. It supports two platforms, and the user is provided with the flexibility to access data securely from anywhere. Frequent updates are maintained to match the current GST rules.

Its user-friendly interface, in combination with good customer support, makes it a stable choice to streamline GST compliance by businesses. GST is fast and accurate, so less wastage of time and maximum profit to the taxmen and the business industries.

Key Features:

- Cloud-based and desktop accessibility

- Supports an unlimited number of clients and returns

- GST-compliant invoicing and billing

- Auto-filling GST returns of all forms

- High-quality reconciliation ITC

- Generation of e-way bill

- Common updates in the norms of GST

Pricing: Starts at: ₹ 5,000

Product Page: http://saginfotech.com/gst-software.aspx

Support: 0141-4072000

3. Saral GST Software

The Saral GST Software is an easy-to-use GST compliance solution that facilitates business and tax professionals due to its user-friendly interface and automation capabilities. It aids in the filing of GST returns and billing, reconciliation, and also offers valuable MIS reports to enable businesses in the analysis of tax liability and compliance trends. The software has an intelligent OTP session management scheme and also secure login and authentication to multi-user environments.

Among its major features is the self-GSTR comparability ability, which helps to match invoices accurately across supplier and buyer files and hence reduces reconciliation errors. It significantly reduces errors in filing, and it facilitates adherence to GST regulations because it has in-built validation checks. Saral GST is appropriate for accountants, SMEs, as well as enterprises that seek a GST-efficient solution that provides ease of use and a complex reporting package.

Its single-user and multi-user generate flexibility based on the size of the business and the demand. Saral GST provides a seamless, GST-compliant, and stress-free GST filing experience with strong support for the customer and ongoing updates.

Key Features:

- Compliance analysis MIS reports

- OTP session controls secure login

- Reconciliation on Auto GSTR comparison

- GST invoicing and printing of bills

- Several forms of returns were supported

- Checks to minimize the filing errors: Validation checks

- Easy to use dashboard navigation User-friendly dashboard Easy to use dashboard

Pricing: Rs 6,900 single-user, Rs 15,000 multi-user

Product Page: http://saralgst.com/

Support: 1860-425-5570

Also Read: Law Practice Management Software

4. HostBooks GST Software

HostBooks GST Software is a cloud-based Billing, GST return, and GST-compliant solution designed to automate GST billing, returns filing, and compliance to assist businesses of all types. It automates the complicated GST processes such as ITC calculation, reconciliation, and report generation to make them easy due to its user-friendly interface. The software would facilitate the creation of GST-compliant invoices in a short time and allow various billing templates that would suit different industries.

Automated input tax credit (ITC) calculation is one of its greatest strengths, as it assists companies in claiming the right credits without the application of human labor. A cloud-based tool, HostBooks can be used at any given time and place that is, which makes it convenient to ensure that everybody in a team or tax professionals communicate without any net hitches. It also provides valuable reports on tracking compliance and eliminates mismatches as GSTR-2A and purchase records are reconciled. It is up to date with the current GST requirements because of the regular updates.

HostBooks was developed specifically to be used by SMEs, accountants, and businesses that have GST to take care of; it provides efficiency, speed, and reliability when it comes to GST management. Its low annual cost makes it a cost-efficient option for businesses that require a secure and contemporary GST calculating solution.

Key Features:

- Anywhere, cloud-based accessibility

- Auto ITC calculation and reconciliation

- Invoicing with multiple templates, GST-conformant

- Automation of all GST forms in terms of returns

- On-to-date backups and synchronizations in real-time

- Compliance reporting and analytics

- Periodic revisions of the recent GST norms

Pricing: ₹ 7,499/year

Product Page: http://hostbooks.com

Support: N/A

5. MyBillBook GST Software

MyBillBook GST software is a mobile-friendly invoicing and billing system suitable for small business owners, traders, and retailers not wanting to use computers and laptops to manage their GST compliance. Its easy-to-use and understand mobile application takes minutes to provide users with GST-compliant invoices that can be shared directly via WhatsApp or email, which makes it the best solution for small businesses where the exchange of invoices occurs rapidly.

The software incorporates such features as payment reminders, expense tracking, and sales reports, which a user can manage to ensure optimized cash flow and customer relationships. It is also capable of managing inventory, ensuring that businesses can track their stocks and enter necessary purchase/sales entries automatically. MyBillBook provides ease in GST return filing as it can prepare GST reports like GSTR-1 and GSTR-3B and can be uploaded on the GST portal.

Many shopkeepers, small-scale service providers, and wholesalers use it because of its ease of operation, even when they do not have a solid knowledge of accounting. The product is built with small businesses in mind, with an aim of empowering them to move towards easy and affordable digitization of operations and being GST-compliant.

Key Features:

- GST invoicing and billing mobile first

- WhatsApp invoice and reports exchange

- Auto-verbal rate detector

- The monitoring of costs and cash flow

- Inventory/ Stocks checking

- GST tentative reports (GSTR-1, GSTR-3B)

- Reports of sales and business performances

Pricing: N/A

Product page: http://mybillbook.in

Helpdesk: +91 740041 7400

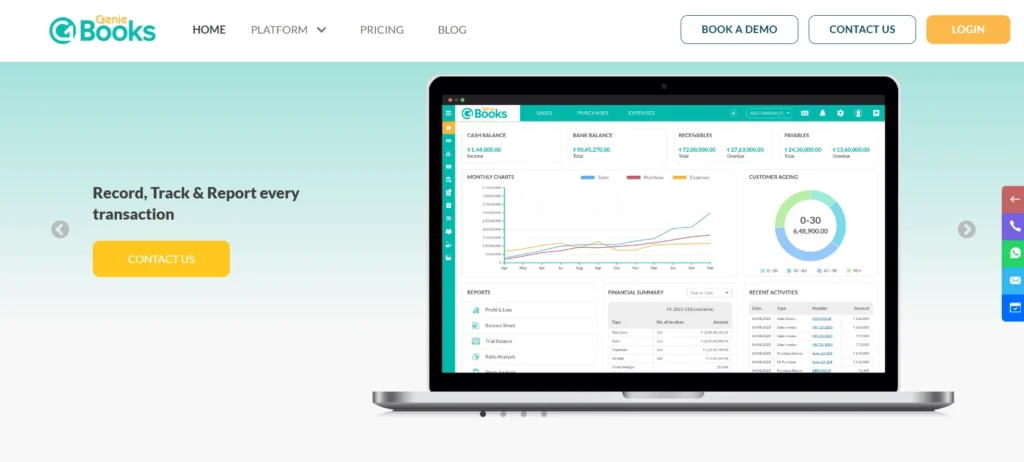

6. GenieBooks GST Software

GenieBooks GST Software platform is a cloud-based SaaS that integrates accounting, inventory management, and GST compliance. It is targeted at expanding businesses in need of a combined solution that needs to handles billing, tax filing, and other financial reports. The software allows GST-compliant invoices, automatic preparation of returns, and real-time tracking of mismatched invoices to reduce compliance risks.

Apart from tax management, GenieBooks allows full-fledged accounting capability, including ledgers, profit and loss, and balance sheets; hence, it is a comprehensive business management program. It has sophisticated inventory tracking that enables the business to track stocks and manage suppliers, purchase orders. Business owners can have a data-driven insight into sales, expenses, and tax liabilities because of the intuitive dashboards.

As a cloud SaaS application, it can process multi-user access and collaboration functionality across devices, making teams more efficient and flexible. GenieBooks is a perfect solution for SMEs and enterprises that wish to have automation, compliance, and clarity of their financials in one program with a combination of accounting, inventory, and GST features.

Key Features:

- SaaS compliance solution to GST

- An automation of GST returns and reconciliation

- Compliant invoicing/billing to GST

- consolidated accounting tools (P&L, balance sheet)

- On-line inventory

- Analytics business dashboards

- Multi-user communication access

Price:

- blue: ₹ 6999/yr

- green: ₹69999/ yr

Product URL: http://geniebooks.com

Contact: +91 8045687700

7. Tally ERP 9

Tally ERP 9 is one of the most trusted accounting and GST-compliant software in India and is deployed in large-scale businesses. It provides a comprehensive GST billing, Return filing, and reconciliation system along with running the day-to-day business functions like accounting, inventory, Payroll, and financial reporting.

Tally ERP 9 is a well-known brand with a track record of reliability and questionable integration where GST invoicing is concerned. Tally ERP 9 is easy to use, with an automatic tax calculator, HSN/SAC code calculator, and GST-compliant reports. The business will be able to produce a GST return devoid of errors and file it directly online.

The software also provides reconciliation- right matching of purchase and sales. It aids in the use of informed decisions as business owners because of its powerful reporting tools. Tally ERP 9 will continue to be a preferred GST management system along with general business accounting, whether you are a CA, tax consultant, or an enterprise.

Key Features:

- GST invoice and return submission

- Auto tax computing & error checking

- Data security and user access: Multi-user access

- Integration of inventory & payroll

- High-level reporting & analytics

- On and offline filing assistance

Pricing: N/A

Product Page: http://tallysolutions.com/gst/gst-software

Support: 18003098859

8. ClearTax GST Software

ClearTax GST Software is an ingenious web-based tool that aims at making GST compliance easy. Certified as a GST Suvidha Provider (GSP), ClearTax supports automation of return filing, reconciliation, and billing with artificial intelligence-driven technology, adding speed, time-saving up to 3 times in comparison to manual methods.

The intelligent reconciliation engine, which auto-matches invoices, could help businesses to maximize Input Tax Credit (ITC) and prevent fines as a result of mismatches. The platform has also been SOC 2 certified to ensure data security and compliance with the best standards. Businesses can print out GST-compliant invoices, e-way bills, and e-invoices with ease, whereas the accountant can handle their numerous clients with ease.

ClearTax also offers elegant dashboards and reporting that enable users to monitor the filing position, ITC, and cash flow on an ongoing basis. ClearTax is the preferred choice of professionals dealing with large volumes of GST filings due to its straightforward user interface and robust automation.

Key Features:

- Machine-learning-enabled reconciliation system

- GST-compliant invoicing/billing

- Direct integration to Shortcuts NG

- CAs: Multi-client management

- SOC 2 data security

- An accelerated rate of 2-3 times the rate of filing returns

Pricing: N/A

Product Page: http://cleartax.in/gst

Support: 080-67454211

9. Zoho GST Software

Zoho Books is one of the most professional cloud-based accounting software in India that has an ultimate GST compliance model. It is a great software ideal for SMEs and startup organizations because its GST software makes it easy to bill and file returns, and reconciliations. Businesses will be able to generate GST-compliant invoices, monitor input credit, to handle HSN/SAC codes.

The software can reconcile automatically with GSTR-2A/2B, which will provide accurate ITC claims. Supporting multi-users and the OTP-secured filing, Zoho Books places priority on user convenience and security. It also has the features in terms of payment reminders, expense tracking, and financial reporting, making it a whole package on the business accounting side.

Its usefulness is increased by the ability to be integrated with other Zoho applications and third-party platforms as well. Zoho GST Software can be considered as a ready-to-present cloud solution that is affordable to businesses because of its pricing and requires flexibility and automation in its efforts to comply with the changes in compliance requirements.

Key Features:

- GST compliance & invoicing on a cloud basis

- Reconciliation of GSTR-2A/2B-automated

- Securing of return filing using OTP

- Tracking expense & payment

- Multi-user collaboration

- Fin. reporting and analytics

Pricing: Request for price

Product Page: http://www.zoho.com/in/books

Support: 18005726671

10. Webtel GST Software

Webtel GST Software is an efficient compliance tool that makes GST return filing, e-invoicing, and e-way bill generation easy, even for small businesses. Its strong fitness with the ERP systems and Excel is a factor that makes it appropriate in companies that handle high levels of transactions. The platform offers real-time validation, clearing of invoices, and corrections of errors to make filings accurate.

Having direct integration with the GSTN, businesses are enabled to file returns safely and at the right time. Reconciliation features allow you to match purchase invoices with supplier data, thus claiming maximum ITC. Besides compliance with GST, the software also facilitates e-INVOICING and generating e-way bills directly through the software, which can help minimize manual work.

It is a popular one among accountants, CAs, and entities that require the filing of returns in bulk with a high degree of accuracy. With its strong customer support, Webtel GST Software is an enterprise-grade solution for hassle-free GST compliance.

Key Features:

- Electronic GST return in situ with the GSTN interface

- e-Way bill generation and e-Invoicing

- Excel and Excel integration & ERP

- Automatic matching of invoices

- Error correction & validation in real time

- Safe multi-client control

Pricing: N/A

Product Page: http://webtel.in

Tel: (011) 45054000

11. Marg GST Software

Marg GST Software is a comprehensive GST billing and GST return filing software customized to retailers, wholesalers, and distributors. Its simplicity of use and automation assist a business in generating GST-compliant invoices with barcode capabilities, inventory management, and reconciliation of transactions without any complexity.

The auto-reconciliation feature available will automatically reconcile purchase invoices with supplier data and hence maximize ITC claims without any manual intervention. It also verifies GSTIN numbers in real time, limiting compliance errors. Marg GST Software allows filing of all major GST forms, including additional features like supplier/customer ledger management, inventory tracking, and tax reports.

It is particularly common with businesses that use large product directories and do numerous business transactions. The Marg GST Software enables both precision and efficiency with its powerful reporting and reconciliation capabilities, and hence, GST compliance is not a time-consuming feature among SMEs and enterprises.

Key Features:

- Does barcode integration with GST-compliant invoicing

- ITC auto-reconciliation of claims

- GSTIN validation of the supplier

- Inventory/ledger management

- Submission of GSTR-1, GSTR-3B, etc.

- In-sightful GST reporting & analytics

Pricing: NA

Product Web Page: http://margcompusoft.com

Support:+91 11-30969600

12. Computax GST Tax Software

The Compultax GST Software is meant to ease the complexities of filing GST returns for tax professionals, businesses, and accountants. It delivers the ease of an intuitive dashboard that complements a centralized view of GST compliance work, such as the preparation, filing, and reconciliation of returns.

Being multiple user-friendly and automating GSTRs preparation, the software is best suited to the firms of CAs or organizations that have extensive client portfolios. It checks validation built-in features and can limit filing errors and speed up return filing.

Its Excel and its ERP functionality guarantee its smooth importing of data and ease the burden of manual work. Bulk data upload, automated GST computation, and compliance tracking are other features that can help save time and create the precision that businesses desire.

Key Features:

- Dashboard to summarise GST compliance

- Auto GSTR preparation & verification

- Multi-user management

- Bulk import/export data

- ERP / Excel combination

- Tracking of reconciliation and compliance

Pricing: N/A

Product URL: http://computaxonline.com/

Support: 0141–4233108

13. GST software QuickBooks

QB GST Software by Intuit is one of the most popular cloud-based accounting platforms that enables easy compliance with GST regulations and financial management capabilities. It supports businesses to easily issue invoices that can be used as GGST-compliant and also automatically calculate the applicable tax rate as per HSN/SAC codes.

It can help make the preparation of returns much easier and use real-time reporting and filing, allowing businesses to stay on top of government regulations. QuickBooks also uses the integration of third-party applications, thus the versatility of companies that use various business applications.

It has an easy-to-use dashboard with variables to get proper visibility of sales, expenses, and GST liabilities so that business owners can make relevant decisions regarding finances. This software is particularly beneficial to small and medium businesses and startups seeking a pocket-friendly and easy-to-reach GST solution.

Key Features:

- Auto GST tax rate applicator

- Mapping of codes – SAC and HS

- Office in the sky invoicing & reporting

- GST-compliant billing & filing

- Live financial intelligence

- Custom required custom integrations

Price: ₹ 529/month

Product link: http://quickbooks.intuit.com

Support: 1877-683-3280

14. Vyapar GST Software

Vyapar GST Software is a mobile-based accounting and invoicing software that is suitable for small-scale businesses, retailers, and wholesalers. The program is known to have usability that allows businesses to prepare GST-compliant invoices, monitor inventory, and follow up on payments on invoices with clients.

It is accessible online and offline, which suits the business establishment even in locations with poor network coverage. In its GST capabilities, it provides the provision of GST returns preparation, automatic calculation of tax, and simplicity in reconciliation, hence, making it effortless to meet requirements with regard to compliance.

Vyapar can also allow companies to record their cash flow, keep their account in order, and provide reports with details. Vyapar has advanced features of barcode scanning, delivery challan, and tracking expenses, which make it a full GST plus accounting tool, especially useful to grow SMEs.

Key Features:

- As a reminder of classroom payment & tracking of expenses

- Works even offline and (Q:) without internet

- Inventory and inventory management

- Auto GST returns preparation

- Barcode and QT, and challan management

Pricing: The starting price is ₹2,399/month

Product Page: http://vyaparapp.in

15. ProfitBooks GST Software

ProfitBooks GST Software is an easy-to-use accounting, suitable for small and medium-sized businesses. It emphasises simplicity of invoicing, GST return preparation, and it has an extended part of returns filing service to its small and medium-sized companies that seek assistance. The software pulls together the invoice detail, tracks the expense, fiscal cash flow, and keeps the records, all with minimal effort by the business.

ProfitBooks is also handy in the management of inventory and fixed assets, thus the business operations of retailers and wholesalers can be run effectively. It is cloud-based and can be accessed anywhere in the world, and its straightforward interface will not leave non-technical users confused, letting them manage GST compliance. The software is best suited for start-ups and expanding businesses that want an affordable but effective solution.

Key Features:

- Easy GST filing service

- Easy system of invoicing

- Budget and \ alarm to expense and cash flow

- Support Inventory management

- Cloud-based accessibility

- User-friendly SMBs

Pricing: ₹499 a month

Product Page: http://www.profitbooks.net

Customer care helpline: 084858 63000

Comparison of Top GST Software in India

| Software | Best For | Key Strengths | Accessibility | Pricing |

| Indian Govt. GST Offline Utility | Small businesses & individuals | Free, official tool, offline return filing | Desktop (offline JSON upload) | Free |

| Gen GST (SAG Infotech) | CAs, accountants, enterprises | Unlimited clients & returns, e-way bill | Desktop + Cloud | ₹5,000 onwards |

| Saral GST | Accountants, SMEs, enterprises | Auto GSTR comparison, MIS reports | Desktop (Single/Multi-user) | ₹6,900 (single) / ₹15,000 (multi) |

| HostBooks GST | SMEs, accountants, growing firms | Cloud-based, auto ITC, compliance analytics | Cloud | ₹7,499/year |

| MyBillBook | Small traders, shopkeepers | Mobile-first invoicing, WhatsApp share | Mobile App | N/A |

| GenieBooks | SMEs & enterprises | Accounting + GST + inventory in one | Cloud (SaaS) | ₹6,999/yr (Blue), ₹69,999/yr (Green) |

| Tally ERP 9 | Large businesses, CAs | Trusted accounting + GST integration | Desktop + Cloud assist | N/A |

| ClearTax | CAs, professionals with bulk clients | AI-driven reconciliation, SOC 2 secure | Web-based (Cloud) | N/A |

| Zoho Books | SMEs, startups | GST + accounting + integrations | Cloud + Multi-user | Request Price |

| Webtel GST Software | Bulk filers, enterprises | ERP/Excel integration, e-invoicing | Desktop + Cloud | N/A |

| Marg GST | Retailers, wholesalers, distributors | Barcode billing, real-time GSTIN validation | Desktop + Cloud | N/A |

| Computax GST | CA firms, tax professionals | Dashboard, bulk uploads, multi-user | Desktop + ERP/Excel | N/A |

| QuickBooks GST | Startups, SMBs | Cloud invoicing + auto tax mapping | Cloud | ₹529/month |

| Vyapar GST | Small retailers & wholesalers | Works offline + barcode/challan support | Mobile + Desktop | ₹2,399/month |

| ProfitBooks GST | Startups & SMBs | Simple invoicing + inventory + cloud | Cloud | ₹499/month |

Conclusion

The size of your business, compliance requirements, and budget should determine what is the right GST software in India to select. Government support, such as GST Offline Utility or basic filing, is complemented by free basic filing tools through advanced features such as ClearTax, Zoho Books, and Tally ERP 9, with provisions of automation, bulk filing, and reporting.

Mobile-first software such as MyBillBook and Vyapar will be ideal and affordable to small enterprises; however, CAs and enterprises can gain better leverage by considering more comprehensive applications like Gen GST, HostBooks, and GenieBooks. Investing in effective GST billing software can help businesses save time, avoid expensive compliance mistakes, and can save more time on growth.

FAQs

Q1. What is GST billing software?

GST platform assists companies in returning, preparing compliant invoices, and automatically reconciling ITC.

Q2. Which is the free GST solution in India?

GST offline Utility by the Indian Government is available free of charge to taxpayers.

Q3. What is the best GST billing software for a small business?

MyBillBook, Vyapar, and ProfitBooks suit small traders and SMEs.

Q4. What is the most appropriate software for CAs and tax consultants?

Gen GST, ClearTa,x, and Computax GST are most suitable for those dealing with more than one client.

Q5. Is it possible to have GST software offline?

Yes, software/programs such as GST Offline Utility and Vyapar have offline facilities.